In my previous blog, I wrote about what products/services are online in India. In it, I referred to the Indian Urban Mass as coined by Goldman Sachs in their detailed report on India. It is a very insightful report and I’m including a couple of images from that report in this blog. At this moment… Continue reading Indian Urban Mass — The Next Frontier?

Tag: india

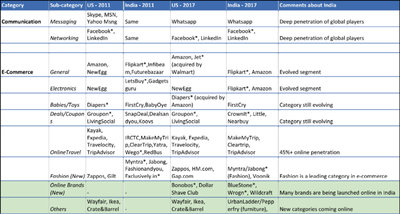

What’s On(line) India — 2017?

This is an update on a blog from 2011 titled What’s On(line) India? I wrote that blog about a year after I moved back from US and compared the online services that were available in India to the ones in the US. I had identified a few areas where the services had just launched in… Continue reading What’s On(line) India — 2017?

Rise of the Indian marketplaces, and what the future holds

Increased connectivity and the spread of smartphones over the past decade have completely transformed Indian commerce. As more and more Indians get access to online services, they become accustomed to buying online – from books and tickets to smartphones, TVs, electronics and increasingly grocery and daily goods. Over time, the dominant business model of e-commerce… Continue reading Rise of the Indian marketplaces, and what the future holds

Global or Indian MBA?

I often get this question. In fact, today I spoke to a candidate who is deciding between a top global B-School and a great Indian B-School. This is a very personal call and so there are no general rules. But, I want to share some of the questions …